-

Bill’s Commentary:

“Thank you Wolfgang. For those who fret about Friday, here is some news on “demand”, and don’t forget, silver cannot be printed and a lower price spurs demand.”

Bill,

It's all coming out in the open. What you've been espousing for some tome now... fractured markets. Everywhere you look, articles are sounding the alarm: the vaults are empty. This is NOT the Hunt brothers scenario of 1980. The silver, this time, is not there.

Wolfgang

The chaotic sell-off exposed a massive structural fracture: the "Great Divorce" between paper contracts and physical metal.

For decades, Wall Street banks controlled silver prices by selling billions in "paper silver"— futures contracts that rarely resulted in actual delivery. But in 2026, China locked down silver exports, creating problems for companies in sectors that need the physical metal for next-gen solar and AI technologies.

Facing a sixth consecutive year of supply deficits, those industrial buyers are no longer settling for cash. Instead, they're demanding bars, triggering a physical scramble that's drained COMEX and LBMA vaults to their lowest levels in decades. As a result, the scramble has created a "backwardation" trap where silver for immediate delivery is far more valuable than a paper promise for next month's delivery.

You can see the strain in the spiking paper-to-physical ratio, which has surged to 528 million ounces of paper exposure to 113 million ounces of physical silver, according to Investing.com.

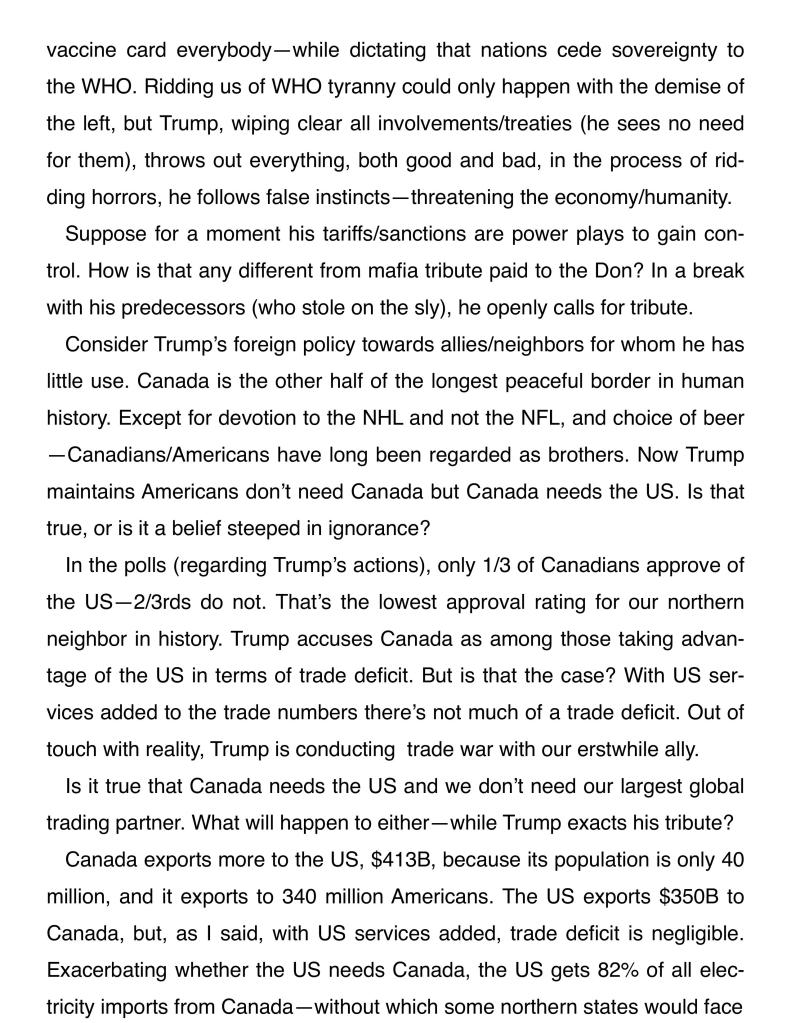

Why silver bears just flipped bullish after record plungeSilver’s 30% plunge on January 30 is one for the record books. The drop in the shiny white metal was the worst since 1980, when the Hunt Brothers tried to corner the market, and it followed a massive silver rally that sent prices soaring nearly 250% in the past year.

The decline wasn’t unexpected. I’ve been tracking markets for over 30 years and wrote last week that Wall Street futures trading legend Peter Brandt and pro strategist Marko Kolanovic were bearish, expecting a major move lower after silver’s parabolic blow-off top.

The latest from USA Watchdog –

-

Bill’s Commentary:

“JJ, because they are paper markets vs real physical markets?”

I’m wondering when this administration will ask Jamie Dimon why COMEX silver is at a $30 discount from Shanghai and who is profiting off the spread?

Why is Shanghai offering $150,000 more per Comex AG contract then we are?

Jeremiah Johnson

Bill’s Commentary:

“Is this because there is too much silver floating around?”

BREAKING: AUSTRALIA’S PERTH MINT SUSPENDS SILVER SALES

Yesterday, we alerted SilverTrade readers that a Major Government Mint was shutting down silver sales within 24 hours.

We can now disclose that the major mint halting silver sales today is The Perth Mint:

Bill’s Commentary:

“Brian,

When all is said and done, the physical markets will pop every paper circuit breaker until their paper burns to ash…” Bill

Hi Bill,

I’ve always heard that the markets have “circuit breakers” and trading halts to prevent massive moves either up or down. Did they unexpectedly fail in silver today like the cameras in Epstein’s jail cell?? Did the servers overheat and prevent the circuit breakers from working? How can any asset drop 30% in a day without any intervention. I guess I already know the answer, the banks, the government and everyone WANTED silver to drop and so the rules were probably ignored. Will any official ever be asked the question? I’m not worried, silver will probably be at all-time highs next week. I’m just so disgusted by the blatant lawlessness of it all. $1,000 silver is coming along with the dystopian world you predict.

Cheers.

Brian

Bill’s Commentary:

“No need to be traumatized, we have watched them do this since the late nineties. Their new problem is this, they can smash prices with the sale of naked contracts all they want, but they can’t print the silver to deliver on these contracts. The efforts to kill price will in reality only bring more buyers worldwide, they shot an entire foot off yesterday. Failure to deliver is right around the corner!”

SILVER’S “IMPOSSIBLE” CRASH: THE NON-BANK ROBBERY

On Friday, January 30, 2026, silver prices collapsed 26.33% in a single day—from $115.81 to $85.31 per ounce. Mathematicians call this a “10-sigma event.”

To understand how rare that is: it should happen once every billion years, not on a random weekday.

When something statistically impossible happens, it’s not magic. It’s mechanics.

The Setup: A Powder Keg

Before the crash, silver was tight. Not “a little scarce”—actually tight:

- COMEX warehouse inventories near historic lows

- Shanghai buyers paying $123 per ounce for physical metal

- Industrial demand (solar panels, electronics) still strong

- Nothing fundamentally changed to justify a price collapse

So why did paper silver crash 26% when physical silver remained scarce?

Who Benefits From a 10-Sigma Crash?

- Large Short Sellers – When you short silver, you promise to deliver actual metal. If you can’t deliver and prices keep rising, you face unlimited losses. A sudden crash forces your opponents (the longs) to sell at terrible prices, relieving your delivery pressure.

- Clearinghouses – These institutions guarantee trades. When too many members face margin calls simultaneously, the clearinghouse itself risks failure. A violent crash reduces open positions and systemic risk—even if it destroys “fair” price discovery.

- Bullion Banks – Major banks often manage mismatches between paper contracts and physical inventory. A crash gives them breathing room to rebalance without chasing higher prices.

- Strategic Buyers – Countries accumulating physical silver (like China) can now buy American panic at $85.13 while holding metal worth $123 in Shanghai.

The Nickel Precedent

This isn’t new. In March 2022, the London Metal Exchange halted nickel trading when prices spiked, then cancelled already-executed trades to protect a major Chinese short seller from default. Winners became losers overnight—not by market forces, but by decree.

What Comes Next?

Here’s the problem: The 10-sigma crash didn’t create new silver. Vaults are still tight. Chinese demand didn’t vanish. Industrial use continues.

Paper price says $85.13. Physical reality says $123. That’s a $37.87 gap that physics, not paper, will eventually resolve.

When it does, expect the opposite: a violent spike upward—possibly the “20-sigma event” needed to correct this distortion. History shows these reconciliations are never smooth. They’re explosive.

The Bottom Line

Ten-sigma events don’t happen naturally in honest markets. They happen when:

- Leverage exceeds available supply

- Powerful players face existential threats

- System preservation trumps price discovery

Someone needed this crash. The math proves it wasn’t random. The beneficiaries are visible in who survives and who doesn’t.

As Shanghai buyers continue paying $123 for physical metal, American paper traders are learning a hard lesson: when reality and derivatives collide, the exchange picks winners.

And 10-sigma events reveal exactly who they chose.

This was a robbery without a gun—executed in plain sight, recorded in every tick of market data. The vault is empty, but the receipts keep printing.

Respectfully,

Michael Quick

-

Bill’s Commentary:

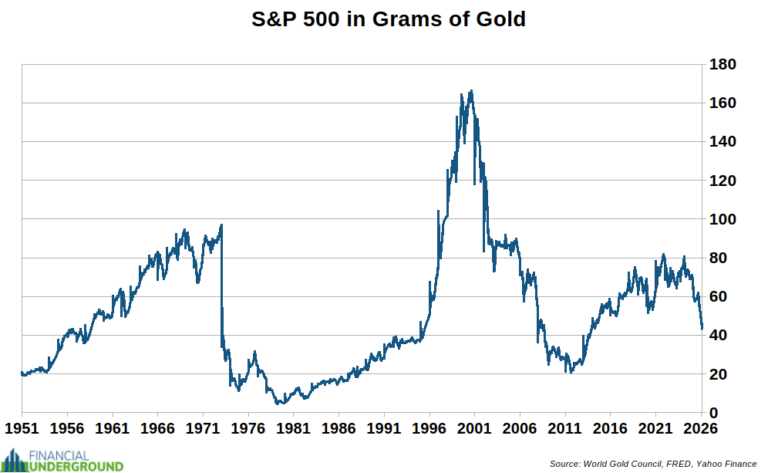

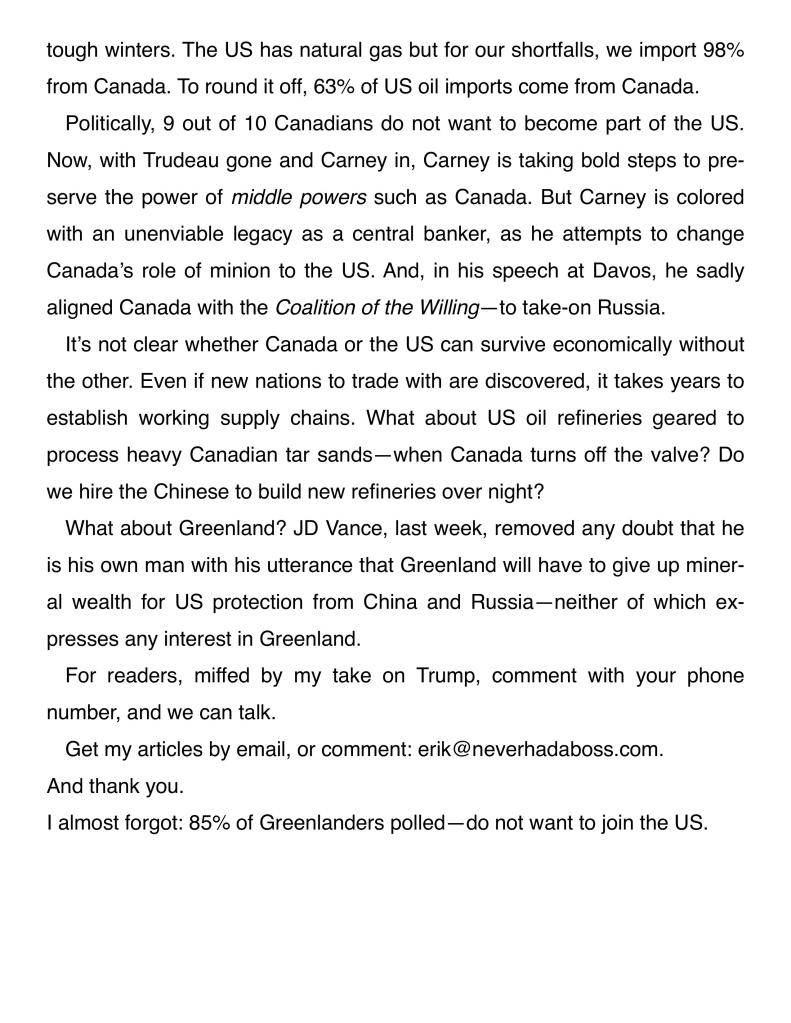

“Gold is the measuring stick.”

The Melt-Up Trap: Why Stocks Must Rise Until the Dollar Breaks

The University of Michigan Consumer Sentiment Index is one of the clearest windows into how the average American actually feels about the economy.

Each month, the university surveys households across the country, asking straightforward questions about personal finances, job prospects, inflation, and expectations for the future. Those responses are distilled into a single number that captures the public’s economic mood. Because it has been tracked for decades, the index offers a long-running reality check on confidence at the household level.

Today, the University of Michigan Consumer Sentiment Index is sitting near record lows — decisively below levels seen during the 2008 financial crisis, the dot-com bust, and even the deep recessions of the early 1990s and 1980s.

Bill’s Commentary:

“True story!”

Bill’s Commentary:

“And there you have it!”

Bill’s Commentary:

“Finance 101 and 100% correct”

Why the Next Recession Will Be the Catalyst for Depression

This is why a recession will catalyze a collapse of the credit-asset bubble-dependent economy down to its foundations.

Narrative control works by having a pat answer for every skepticism and every doubt. Boiled down, the dominant narrative holds that the Federal Reserve (central banking) and the central government have the tools to quickly reverse any dip in GDP, a.k.a. recession, and return the economy to expansion.

The unstated foundation of this narrative is that recessions are bad, as only permanent expansion is good. That this isn’t “free market capitalism” doesn’t bother anyone, because the whole point of central banking and government is to eliminate the rough edges of “free market capitalism” with the sandpaper of “state capitalism,” which creates or borrows as much money as needed to smooth over any spots of bother, a.k.a. recessions.

Bill’s Commentary:

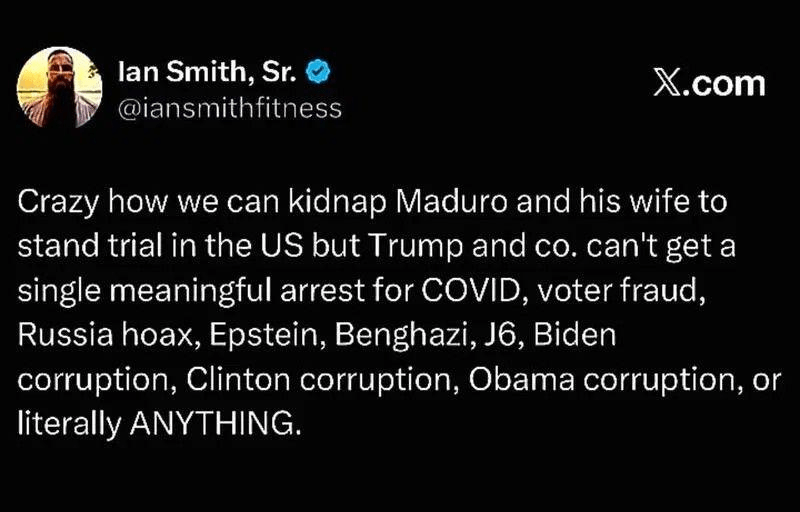

“It’s always “divide and conquer”!”

The latest from Erik –

-

Bill’s Commentary:

“WOW!

@KingKong9888

The biggest precious metals recycler in China, Rongtong Gold, is now offering Chinese consumers a buy-back price for #Silver at the USD equivalent of $128.52 per troy ounce (VAT-exempt), well above prevailing international #Silver spot price levels.

#Gold #Silver”

-

Bill’s Commentary:

“Gold is the measuring stick…”

The latest from USA Watchdog – (also posted under Interviews)

Bill’s Commentary:

“Lies, lies, and more lies!”

The latest from Erik –

-

The latest from USA Watchdog –

-

Bill’s Commentary:

“This is an unintended consequence of running around the geopolitical world like a bull in a china shop…”

Repatriate the gold’: German economists advise withdrawal from US vaults

Shift in relations and unpredictability of Donald Trump make it ‘risky to store so much gold in the US’, say experts

‘Repatriate the gold’: German economists advise withdrawal from US vaultsGermany is facing calls to withdraw its billions of euros’ worth of gold from US vaults, spurred on by the shift in transatlantic relations and the unpredictability of Donald Trump.

Germany holds the world’s second biggest national gold reserves after the US, of which approximately €164bn (£122bn) worth – 1,236 tonnes – is stored in New York.

Emanuel Mönch, a leading economist and former head of research at Germany’s federal bank, the Bundesbank, called for the gold to be brought home, saying it was too “risky” for it to be kept in the US under the current administration.

Bill’s Commentary:

“This is pretty much correct, the “plumbing” in markets all over the world is beginning to plug…”

Bill’s Commentary:

“Can I get sued for calling a Canadian a faggot?”

Davos 2026: Special address by Mark Carney, Prime Minister of Canada

- This blog contains the full transcript of a special address by Mark Carney, Prime Minister of Canada, delivered at the World Economic Forum’s Annual Meeting 2026 in Davos.

- Carney emphasized the end of the rules-based international order and outlined how Canada was adapting by building strategic autonomy while maintaining values like human rights and sovereignty.

- The Canadian PM called for middle powers, such as his own, to work together to counter the rise of hard power and the great power rivalry, in order to build a more cooperative, resilient world.

This transcript was produced using AI and subsequently edited for style and clarity. The edits do not alter the substance of the speaker’s remarks.

Thank you very much, Larry. I’m going to start in French, and then I’ll switch back to English.

[The following is translated from French]

Thank you, Larry. It is both a pleasure, and a duty, to be with you tonight in this pivotal moment that Canada and the world going through.

Today I will talk about a rupture in the world order, the end of a pleasant fiction and the beginning of a harsh reality, where geopolitics, where the large, main power, geopolitics, is submitted to no limits, no constraints.

-

Bill’s Commentary:

“Any number is plausible, any “final” number you hear or read will almost certainly be WAY TO LOW!”

Gold revalued to $73,500 is plausible according to US Treasury statements.

SILVER is about to BUST THROUGH 100 DOLLARS AN OUNCE.

That is not a price; it is a verdict. Years of gaslighting by Wall Street, years of paper games in London and New York, just collided with the physical reality of the most strategically necessary metal on Earth.

In the real world, silver is the wiring, skin, and nervous system of modern power.

Military and aerospace systems rely on silver in guidance electronics, satellite communications, heat sinks, night-vision optics, and laser platforms because nothing carries current or sheds heat as efficiently under extreme stress.

Bill’s Commentary:

“For those of you who believe Trump has not done a single “good thing”… here is something fantastic!”

US Officially Exits World Health Organization

“Today, the United States withdrew from the World Health Organization, freeing itself from its constraints, as President [Donald] Trump promised on his first day in office,” Secretary of State Marco Rubio and Health and Human Services Secretary Robert Kennedy, Jr., declared in a Jan. 22 joint statement.

“This action responds to the WHO’s failures during the COVID-19 pandemic and seeks to rectify the harm from those failures inflicted on the American people.”

This is the latest move by an administration that has been highly skeptical of membership in a number of global organizations that, in Trump’s view, and that of many conservatives, compromise the sovereignty of the United States and operate counter to America’s interests. In January 2025, Trump withdrew the United States from the Paris Accord, which aims to limit global warming, and on Jan. 7, he withdrew en masse from 66 U.N.-sponsored climate and social justice organizations, among them the U.N. Framework Convention on Climate Change.

Bill’s Commentary:

“Welcome to my world Erik! I wrote for years and would piss off one side or the other with anything I wrote. What I don’t get is how you live where you live? I would have lost it many years ago…!”

The latest from Erik –

-

Bill’s Commentary:

“Bye bye carry trade…”

Japan Bond Meltdown Sends Yields to Record High on Fiscal Fears

(Bloomberg) — The slump in Japanese bonds deepened Tuesday, sending yields soaring to records as investors gave a thumbs down to Prime Minister Sanae Takaichi’s election pitch to cut taxes on food.

The 40-year rate rocketed past 4% to a fresh high since its debut in 2007 and a first for any maturity of the nation’s sovereign debt in more than three decades. The jump in 30- and 40-year yields of more than 25 basis points was the most since the aftermath of President Donald Trump’s Liberation Day tariffs onslaught in April last year.

A lackluster auction of 20-year earlier underscored broader worries over government spending and inflation. Treasuries, already under pressure on concern that tariffs may dim the allure of US assets, extended declines as the selloff in Japanese debt accelerated.

-

The latest from USA Watchdog –

Bill’s Commentary:

“More from our pal Stanley on Nat Gas”

Natural Gas Futures up BIG again; now +60% in 2 days

Natural gas prices have skyrocketed again today bringing the two day increase in the February futures to UP 60% IN 2 DAYS!

Yes, there is a big storm coming this weekend with a pretty severe cold snap in temperatures. This rise in price is only eclipsed by the one day increase of 72% on January 27, 2022 which has been credited mainly to the expiration of the Feb 2022 futures contract. In addition to the cold snap in January 2026 we are also on the cusp of world war and inflation in almost all things but gas prices (which may change soon).

If natural gas prices remain elevated that would increase heating costs for much of the United States. That creates one more nail in the coffin of an affordable American lifestyle for the middle class.

Bill’s Commentary:

“I am not a Trumptard, nor do I have TDS. I believe this is a little too harsh…”

The latest from Erik –

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.